This is essentially a review of Starling Bank. Spoiler alert - they did not do well.

When I have a poor experience with a company I do like to tell them about it. I'll drop them an email or send them a Tweet. Rarely do I go to the effort of posting a blog post. Mainly because the issue isn't complex enough to write enough about to justify a blog post.

Starling Bank is one of those fintech companies. An app based bank which sells itself on making international payment simple and cheap. You can use you card abroad and pay a fair exchange rate, and more recently you have been able (apparently) to send international payments to foreign countries.

Starling Bank recently raised £75 million and are apparently focussing on European expansion following in the footsteps of their rivals. I think they should take a step back and invest that money in making their product less bad before expanding their customer base and pushing issues like that described below on more unsuspecting people.

Here are a series of areas in which I personally think that money would be better invested.

In App Customer Service.

One of the unique selling points of mobile banking is that without a need for branches there is more money available to provide a good customer service experience.

Being a mobile bank offering in app chat support/messaging is the logical way to go.

Starling Bank do but it is awful.

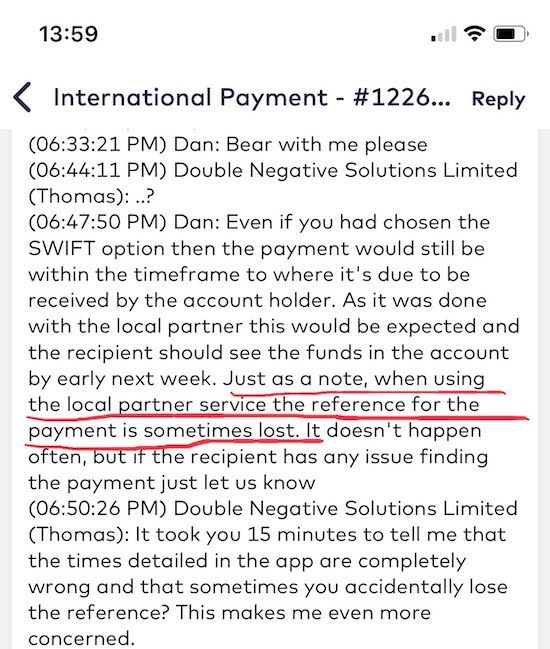

- The support staff do not understand the product. You can not provide support for something that you do not understand.

- The support staff are extremely slow at replying. This suggests that there are not enough of them or they hate their jobs. This is made worse by the worst chat user I have seen in a mobile app. The ... 'agent is typing' bubbles appear very regularly (almost consistently) yet when you get your ill informed response 15 minutes later it amounts to 2 sentences. It is possible that the staff are simply very slow at typing .

- When you continue to have issues with the product you can refer back to previous chats in the 'Starling Inbox'. Again.. who designed this?! Your chats are unformatted blobs of text. What bemuses me is the fact that you've just built a mobile bank yet you can format the content of a table cell?

- If you use their business banking you will (obviously) find your chat logs under the 'Starling Inbox' for your personal account. After all, why put them in the logical place?

International Payments

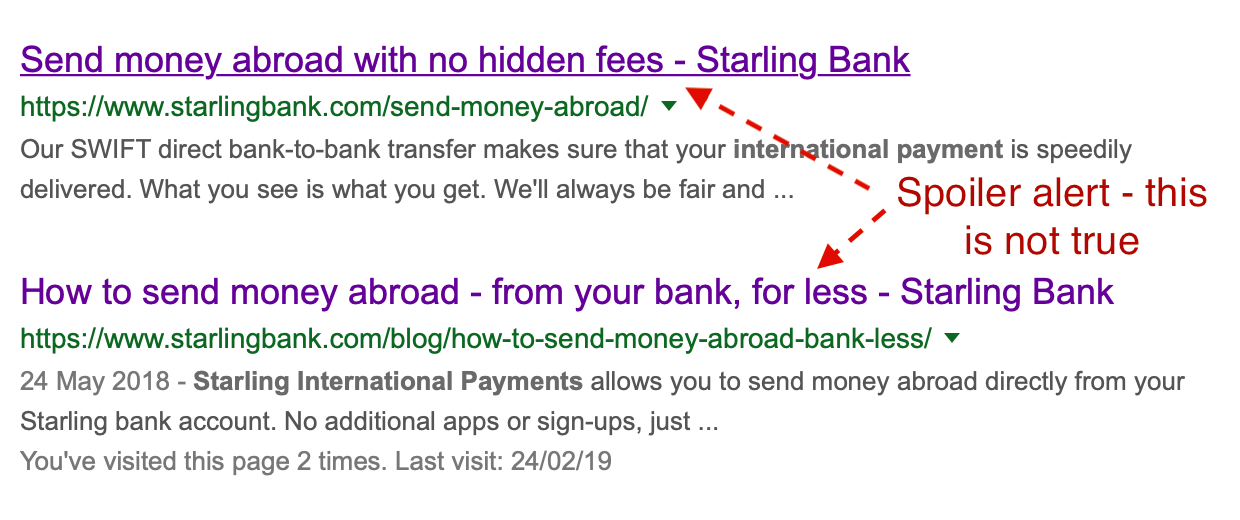

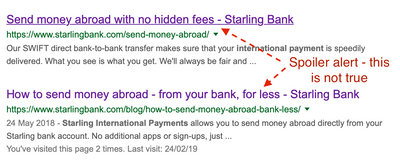

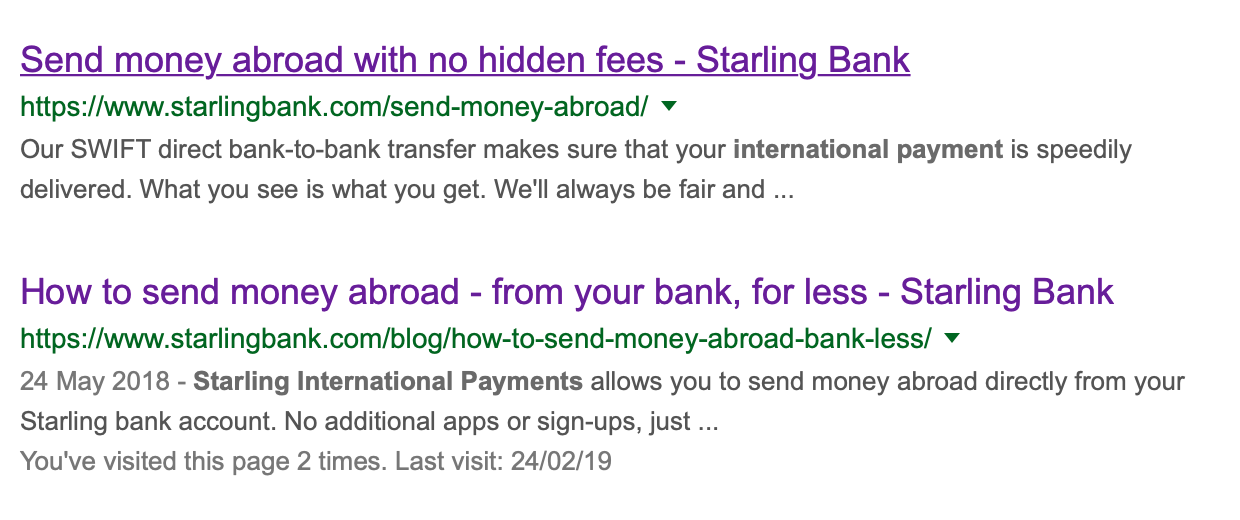

Starling has a nice web page about sending money abroad.

As you can see from the above screenshot we are going to be able to send money abroad 'with no hidden fees' and 'for less'. They are quite explicit in those statements. It is a shame that they are not quite (at all) true. Let me explain..

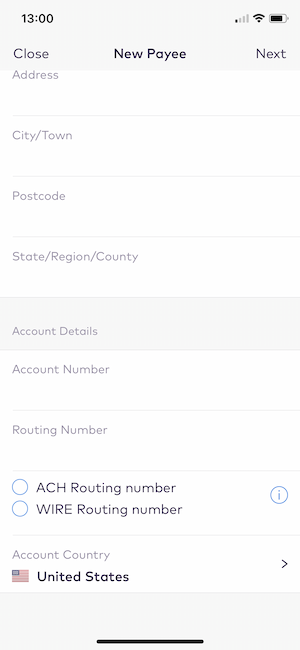

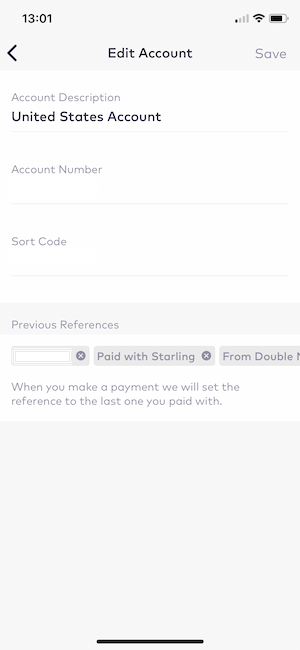

To send an international payment to the USA you have to use this extremely unclear and all round terrible user interface. You get the impression that you might need to provide different information for different payment methods but they really don't make it clear.

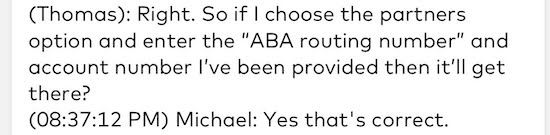

One can safely assume that if you choose 'WIRE' as the 'Routing code type' they are going to send the payment via wire transfer.. right? Just in case it is best you check with their support team using the aforementioned awful chat (I did). He told me that what I was doing was correct. Spoiler - it was not.

When sending the payment you can choose between two payment mechanisms 'Via SWIFT network' (interestingly there is no input for the SWIFTBIC code if you do choose to use SWIFT and they do not ask for the receiving banks address so they really are making this hard for themselves) or 'Via Local Partner'. After seeking clarification from the support operator I opted for the local partner option. SWIFT works but surely sending the payment from a US bank is going to be quicker and given that the user interface estimates that either method will take 1 day we have no real problems.. right? Wrong.

- Starling Bank's local partner is not local ('relating or restricted to a particular area or one's neighbourhood') to the payment destination.. it is local to Starling Bank. It is local to the UK. Their head office is in London. I.e it is just a partner.

- That partner is Currency Cloud. Now I am not sure why but Starling were really not transparent about this at all. Numerous Tweets and support queries asking who the partner was yielded no response. I am unsure if the people in question simply did not know or if they intentionally don't want to be transparent. In my opinion this should be front and center on their international payments page. After all, why shouldn't your customers know who is actually handling their money?

- Also interestingly I have been informed by a third party that a lot of American banks blanket block payments from Currency Cloud. I am unsure why but surely it is worth telling your customers that a lot of intitutions wont accept the payment you are trying to send?

- The short version is that Currency Cloud did not send the payment via wire transfer. The payment was rejected by the receiving bank as a result. The money was returned to me (surprisingly quickly) at the days exchange rate (which had moved unfavourably). I lost out on £160 and my payment had still not been sent. Interestingly I found this out by contacting the receiving bank whose support was exemplary. They answered all of my questions and my previous questions that I had asked Starling to my satisfaction in 10 minutes (total). To be clear, yes it was easier to contact someone elses American bank than it was to get answers from my own.

So.. Things Starling could spend part of that £75 million on? Refunding customers who lose out financially as a result of poor user interface design, and unknowledgable support staff. Refunding customers who lose out financially as a result of a lack of clarity/transparency in relation to the partners with whom you associate.

Note. I have reached out to Starling in relation to this and am hopeful that they will do the right thing in relation to this. I will update.

Pay rises.

I have found historically that Twitter is a good platform for engaging with companies. They tend to reply quicker. I found success Tweeting @StarlingBank asking them for clarity on things. They tended to respond relatively promptly. That is good. Unfortunately it was not often with meaningful updates. It was mainly apologies.

Eventually after various support chats and Tweets I got a message from Theo in the 'Exceptions Team' at Starling stating that he would call me. He did. It was however a shame that I had to continue following up and pushing to get this call. I had been told by the support staff the previous evening that I would get a call in the morning. I (of course) did not.

I outlined all of my issues. He was polite, acknowledged the issues, and noted their significance. If he didn't have an answer he was up front about it. He was transparent in answering my various queries and accepted that a lot of that mentioned above was not up to an appropriate standard. My experience with Theo was very good. He is investigating covering my losses from my experience (as mentioned above) which is appreciated. He should probably get a pay rise.

Summary/General Thoughts

My big issue here is that Starling is a well funded company yet their app is really quite bad. It is not 'crashes every 30 seconds' bad but many important areas of functionality are not usable. Do they not appreciate that international banking is complex and that by releasing a poor/unclear product you are simply costing yourselves money supporting that poor product?

The premise of their product is to simplify things and make things cheaper. They imply that those big bad 'legacy' banks are ripping you off and providing outdated/complex systems yet in my opinion it is Starling doing that.

Amusingly, in the end I did the transfer with one of these legacy banks and whilst it did cost more the user experience and process was fantastic and the payment cleared on the other end in 20 hours. Furthermore it would have been cheaper to use said legacy bank from the get go given the stress caused by using Starling, the time invested in resolving things, and the hidden costs to myself that resulted from Starling sending the payment incorrectly.

Now. I think I know why.

Here is an interesting article about Tom Blomfield, CEO of Monzo, one of Starling's big competitors. Here is a quote:

Yet Monzo wasn’t an entirely novel idea. Blomfield isn’t allowed to talk about why he left his role as chief technical officer at what is today one of Monzo’s chief rivals, Starling, the bank founded by Anne Boden in 2015 and where Blomfield worked prior to launching Monzo. There were reports of rifts and tension at the time. Whether that stemmed from diverging strategies or a desire from Blomfield to run his own venture is unknown.

Now, I do not know why Tom Blomfield left Starling, but I do know that in my opinion Monzo is a much better product than Starling. I suspect the "reports of rifts and tension" may be true and as such Starling is pushing to beat Monzo. Pushing by moving quickly. Sadly as any software engineer knows moving quickly and moving well normally do not go well together.

From what one can see from the outside, Monzo approach things with a very methodical approach - slow and steady wins the race. They are building business bank accounts but they are doing so slowly to make sure (I assume) that what they release is actually good. I suspect Starling pushed out business accounts and international payments to have a USP over Monzo. It worked in many respects as whilst I do have a personal account with Monzo, as this post implies I have a business account with Starling.

The thing that disappoints me most though is the seeming lack of effort. Have Starling genuinely not even tested their products? Hopefully the screenshots above show how poor/unclear the user experience is. Did they not get a single person who regularly makes international payments to actually use the product? Similarly with their user support. They seem to have broken all the rules of 'Releasing a production product 101' and given how much money they have that bemuses me immensely.

The TL;DR of this all is that Starling markets themselves as having no hidden fees. They do have hidden fees - you will lose £160 and have to use a different bank to actually send your payment. By extension their sentiment that you can send money 'for less' is also not true.

Whilst things worked out for me on this occasion, depending on the time sensitivity of your transaction it could cost you a lot more. In the case of my payment the recipient was expecting a prompt payment. It ended up taking 5 days - 4 days for Starling to mess everything up and return less money and then 1 day for me to send the payment with an alternative bank.

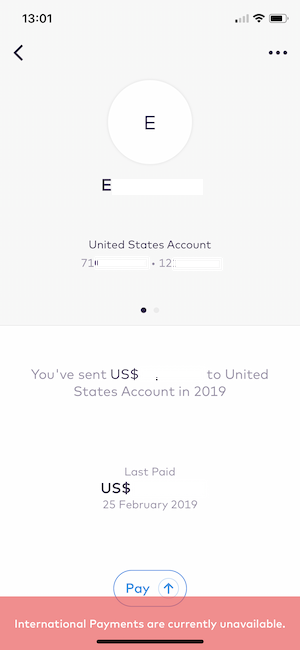

Theo (mentioned above) did take note of my complaints and concerns and it seems like international payments (at least to the US) are now not available in the Starling app. Hopefully they are acting on the suggestions and fixing the various issues.

Would I reccomned Starling? At this point in time, no I would not.